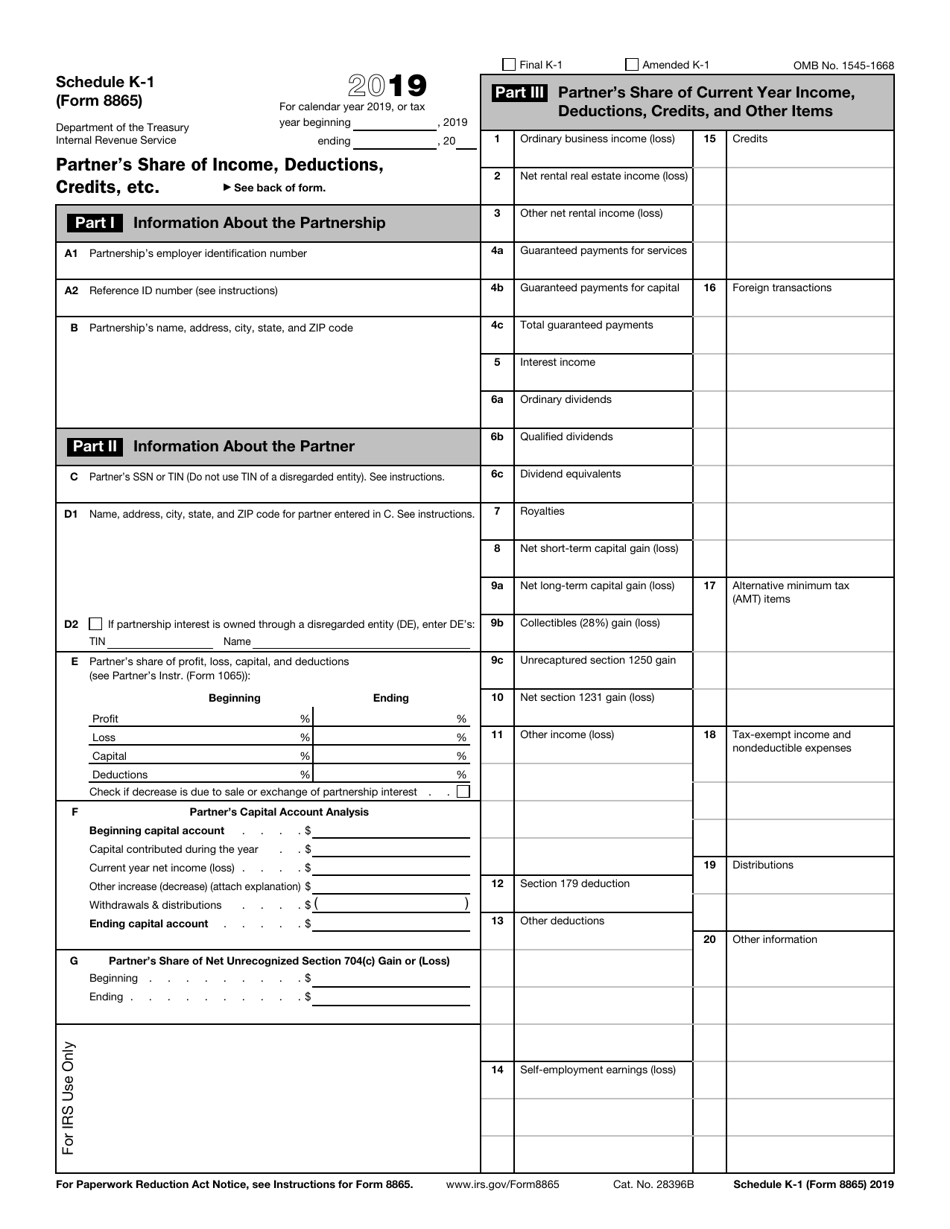

Subtract (-) Your decreased share of partnership liabilities minus your share of liabilities from the prior year.Subtract (-) Withdrawals and distributions of money and the adjusted basis of property distributed to you from the partnership (property distributions part of your taxable income are NOT included).Add (+) Your share of excess deductions for property depletion (other than oil and gas depletion) over the property’s adjusted basis.Add (+) gains on property contributions (gains from the transfer of liabilities are NOT included).Add (+) Your share of the partnership’s income or gain (including tax-exempt income).Add (+) Your increased share of partnership liabilities minus your share of liabilities from the prior year.Add (+) Money and any percentage of property contributed to the partnership minus any associated liabilities.

It is zero if it is your first year in the partnership, it cannot be less than zero. First, you take your tax basis on the very last day of the prior year.

0 kommentar(er)

0 kommentar(er)